There also may be differences between the tax bases and the recognized values of assets acquired and liabilities assumed in an acquisition by a not-for-profit entity or between the tax bases and the recognized values of the assets and liabilities carried over to the records of a new entity formed by a merger of not-for-profit entities. There may be differences between the tax bases and the recognized values of assets acquired and liabilities assumed in a business combination.

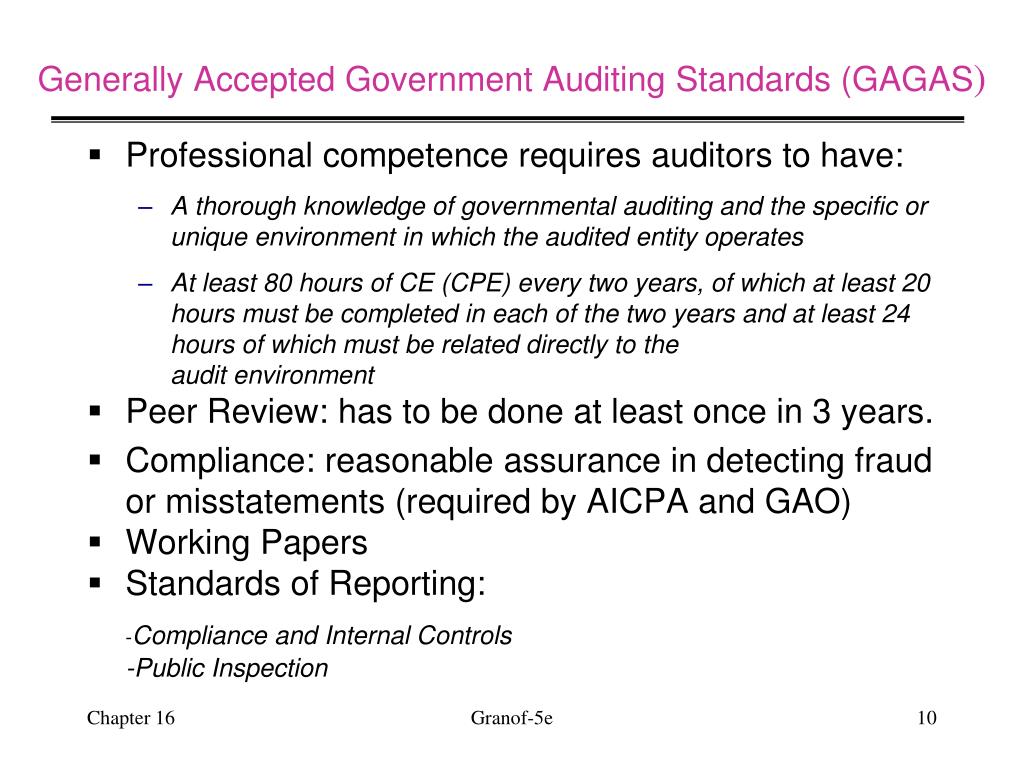

#Generally accepted auditing standards 3.2 full

For example, a tax law may provide taxpayers with the choice of either taking the full amount of depreciation deductions and reduced tax credit (that is, investment tax credit and certain other tax credits) or taking the full tax credit and reduced amount of depreciation deductions. Amounts received upon future recovery of the amount of the asset for financial reporting will exceed the remaining tax basis of the asset, and the excess will be taxable when the asset is recovered.

Future sacrifices to provide goods or services (or future refunds to those who cancel their orders) will result in future tax deductible amounts when the liability is settled. For tax purposes, the advance payment is included in taxable income upon the receipt of cash. A liability (for example, subscriptions received in advance) may be recognized for an advance payment for goods or services to be provided in future years. Revenues or gains that are taxable before they are recognized in financial income.A liability (for example, a product warranty liability) may be recognized for expenses or losses that will result in future tax deductible amounts when the liability is settled.

Expenses or losses that are deductible after they are recognized in financial income.An asset (for example, a receivable from an installment sale) may be recognized for revenues or gains that will result in future taxable amounts when the asset is recovered. Revenues or gains that are taxable after they are recognized in financial income.Based on that assumption, a difference between the tax basis of an asset or a liability and its reported amount in the statement of financial position will result in taxable or deductible amounts in some future year(s) when the reported amounts of assets are recovered and the reported amounts of liabilities are settled. Transfers and servicing of financial assetsĪn assumption inherent in an entity’s statement of financial position prepared in accordance with generally accepted accounting principles (GAAP) is that the reported amounts of assets and liabilities will be recovered and settled, respectively. Revenue from contracts with customers (ASC 606) Loans and investments (post ASU 2016-13 and ASC 326) Investments in debt and equity securities (pre ASU 2016-13) Insurance contracts for insurance entities (pre ASU 2018-12)

Insurance contracts for insurance entities (post ASU 2018-12) IFRS and US GAAP: Similarities and differences Business combinations and noncontrolling interestsĮquity method investments and joint ventures

0 kommentar(er)

0 kommentar(er)